The Roman Empire’s grandeur is often celebrated for its vast territory and military might, but beneath this surface of power lay an economic struggle that ultimately contributed to its downfall. The slow, deliberate debasement of Roman coinage tells a powerful story of inflation, fiscal mismanagement, and the impact of these financial troubles on the empire’s stability. By examining the decline of the denarius and the rise of its diminished counterparts, we gain insight into the internal pressures that weakened an empire once believed to be invincible. This journey through Roman coinage reveals how financial decisions can shape the fate of entire civilizations.

The Early Years of the Denarius: Stability and Trust

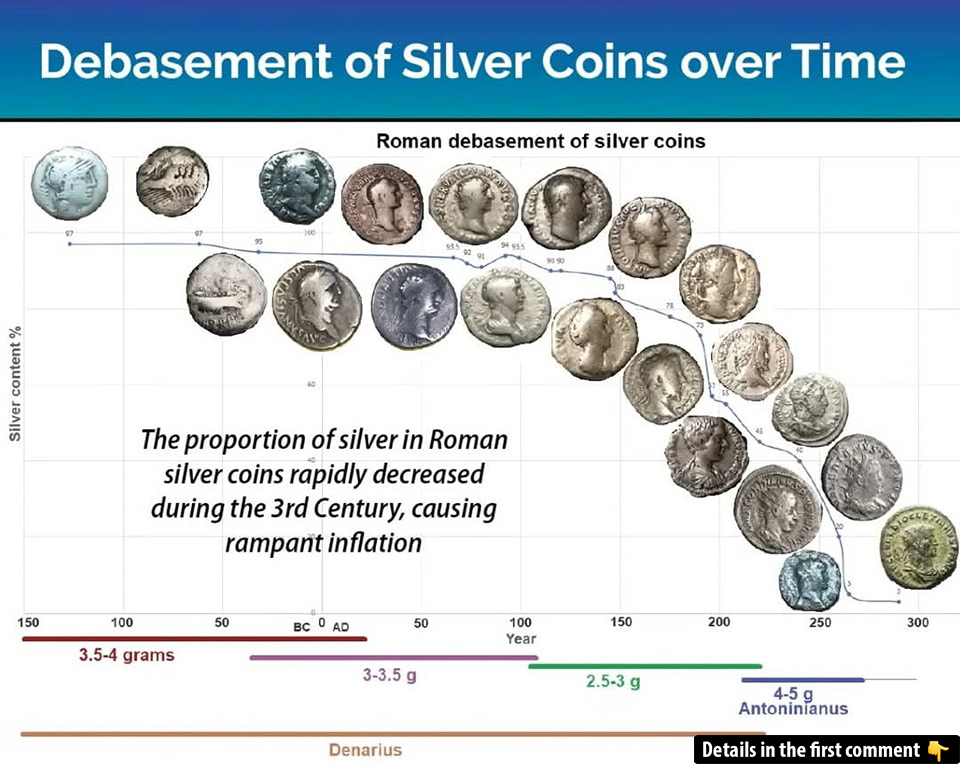

Initially, the Roman denarius, introduced in 211 BCE, was a symbol of Roman economic strength and political stability. Made of nearly pure silver, the denarius was used for everyday transactions and served as the backbone of the Roman economy. The silver content remained relatively stable for centuries, making the denarius a trusted medium of exchange. It was also an important tool for Roman emperors, used to disseminate imperial propaganda. The faces of emperors were often minted on the coins, serving to remind the people of the emperor’s power and the empire’s achievements.

During the reign of Augustus, the first Roman emperor, the denarius maintained a high silver content of about 95%. It remained relatively consistent throughout the reign of his successors, including the Flavian Dynasty and into the reign of Emperor Nero. The denarius, while fluctuating slightly, remained a strong, dependable currency for over a century. However, as the empire’s expansion and military costs increased, the initial stability of the Roman currency began to erode.

Video

Check out this documentary video on how inflation played a key role in the fall of Rome, exploring its economic history in depth.

Nero’s Debasement: A Precedent for Future Emperors

The first significant debasement of Roman coinage occurred under Emperor Nero, who ruled from 54 to 68 CE. Nero’s reign was marked by extravagant spending and a growing need for funds to support the military and public works. Faced with a dwindling supply of precious metals, Nero decided to reduce the silver content of the denarius by 14%. The new denarii minted during his reign contained only 86% silver, a significant reduction from the earlier coins.

Nero’s decision to debase the coinage was driven by the pressing need for money to finance his government’s operations, including the construction of grandiose public buildings and the funding of military campaigns. To counteract the declining silver content, he also added a 10% alloy of cheaper metals, further lowering the value of the denarius. Although this move temporarily increased the money supply, it set a dangerous precedent that would be followed by future emperors. Over time, the debasement of the denarius would become more severe, resulting in widespread inflation and a loss of public trust in the currency.

The debasement under Nero marked the beginning of a downward spiral in Roman coinage, which would continue for centuries, eventually contributing to the empire’s economic collapse.

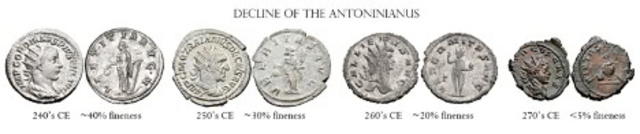

Caracalla’s Antoninianus: The Coin of Inflation

By 215 CE, Emperor Caracalla introduced a new coin, the antoninianus, which was initially valued at two denarii but contained only 1.5 times the silver content of the denarius. The antoninianus was meant to be a larger, more valuable coin, but in reality, it was only a temporary solution to the empire’s mounting fiscal crisis. Over time, the silver content of the antoninianus was reduced even further, leading to rampant inflation.

The introduction of the antoninianus was a key moment in the Roman Empire’s economic history. It was not just a new coin; it was a symbol of the empire’s increasing reliance on debasement to meet its financial needs. As the silver content of the antoninianus continued to fall, prices in the empire began to rise sharply. The denarius, once the cornerstone of Roman coinage, was increasingly replaced by this new, less valuable currency. This move contributed significantly to the decline in the value of money and the erosion of confidence in the Roman economy.

The Social Impact: Inflation and the Collapse of the Middle Class

The effects of this inflation were felt by the Roman populace, especially the lower classes and small landholders. As the value of the currency diminished, the cost of goods and services increased dramatically. Small landowners, unable to keep up with the rising costs and the devaluation of the coinage, began to lose their land. Many of them were forced to become tenants or serfs under larger landowners who could afford to weather the economic storm.

In many parts of the empire, the shift from a money-based economy to a barter system began. Those without enough wealth to trade in currency found themselves struggling to survive. In some regions, entire communities reverted to more primitive economic systems as inflation spiraled out of control. This economic instability was one of the factors that contributed to the rise of Christianity. As the Roman government’s ability to provide for its citizens dwindled, Christian communities were often able to offer support to those in need, gaining followers and influence in the process.

The Role of Gold Coinage: A Relative Stabilizer

In the midst of this turmoil, the Roman Empire did have one asset that maintained its value: gold. The aureus, the Roman gold coin, remained relatively stable throughout the crisis. While the silver coins, particularly the antoninianus, lost their value, gold coins continued to hold their worth. This allowed the empire to maintain some degree of fiscal control and pay its soldiers, who were essential for maintaining order within the empire.

However, the reliance on gold also had its limitations. Most of the empire’s gold was used to pay the army and bribe barbarian invaders, further straining the economy. Despite the relative stability of gold, the collapse of the silver coinage and the widespread inflation left the empire’s financial system in disarray.

The Fall of the Western Roman Empire: A Complete Economic Breakdown

As the Roman Empire fractured into multiple parts during the 3rd century CE, the economic situation worsened. The empire was divided into the Gallic Empire in the west and the Palmyrene Empire in the east. These divisions further complicated the economic landscape, with each region facing its own fiscal challenges. The use of debased coinage and the reliance on gold to pay soldiers made it increasingly difficult for the empire to maintain its power and influence.

By the time of Emperor Aurelian in the 270s CE, the empire had been severely weakened. Aurelian managed to reunify the empire, but the damage done to its economy was irreversible. The gold coinage, which had been a relative stabilizer, was no longer enough to prop up the faltering empire. The Roman economy had reached a point where even the imperial currency was no longer reliable, leading to the eventual collapse of the Western Roman Empire in the 5th century CE.

Lessons for Today: What Modern Economies Can Learn from Rome

The story of the Roman Empire’s economic decline offers valuable lessons for today’s economies. The practice of debasing currency to solve financial problems may offer short-term relief, but it often leads to long-term instability. The Roman Empire’s reliance on coinage as a reflection of political and economic health demonstrates how crucial sound fiscal policies are to the success of a nation.

In modern times, the Roman experience serves as a cautionary tale for governments considering the potential consequences of manipulating currency. While inflation may provide temporary relief in times of crisis, it often comes at the cost of public trust and economic stability. The rise of fiat money, without the backing of precious metals or tangible value, can lead to disastrous consequences for both the economy and the population.

Video

Watch this exciting video from Pawn Stars as they make a big bet on a ridiculously rare ancient Byzantine coin in Season 8.

Conclusion: The End of Roman Coinage and the Legacy of Inflation

The gradual debasement of Roman coinage, from the early days of Augustus to the fall of the Western Roman Empire, reflects the larger story of the empire’s economic struggles. The shift from a stable, trusted currency to one plagued by inflation and devaluation contributed significantly to the collapse of Rome. As we look back at the history of Roman coinage, we can see how fiscal mismanagement and inflation undermined one of the world’s greatest empires. While the Roman Empire is long gone, its economic lessons continue to resonate today, reminding us of the importance of sound financial policies and the dangers of manipulating currency.